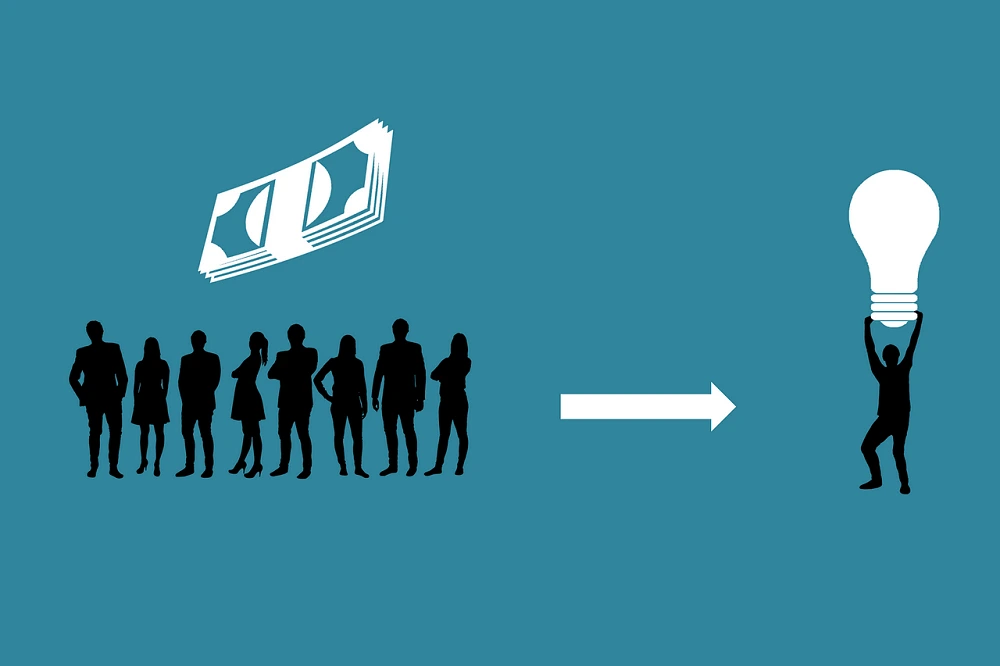

beginning with a little company Money is necessary to fund a business. Of all the financial decisions business owners make, funding their company comes first and is the most crucial. The finance you select will determine how your business is organized and run.

Calculate the required financial amount.

Since each business has unique demands, no financial solution would be suitable for all of them. More than anybody else, your vision and your financial circumstances will determine the financial destiny of your firm.

It would be easier for you to choose where to get the start-up funds if you know how much you need.

Read also: How to Withdraw from a Real Estate Crowdfunding Services

Invest yourself to support the expansion of your company.

Self-funding, often known as bootstrapping, allows you to contribute your own funds to your company. You can self-fund by using your savings accounts, your 401(k), or even by asking friends and family for financial assistance.

Self-funding allows you to keep all control over the firm while exposing you to all risk. Be extremely cautious while using retirement assets early in life; in general, try not to spend more than you can afford. It is advisable to first inquire with your plan administrator and personal financial counselor to see whether you may face costly fines or penalties or risk jeopardizing your ability to retire on time.

Get investors to provide venture funds

Venture capital investments let investors provide money for you to launch your company. Usually, venture cash is presented in return for an ownership portion and active firm participation.

In many significant respects, venture capital is different from conventional funding. Usually: Venture capital

- focuses on companies that are expanding quickly.

- Not a loan; investments are made in exchange for equity rather than debt.

- Take on additional risks in the hopes of maybe receiving bigger benefits.

- extends beyond traditional financing terms.

At least most of the venture investors will seek a seat on the board of directors. So be ready to trade some control and ownership of your business for money.

Read also: The Best Y2K Tech Presents That Our Editors Still Can't Get Enough

Where may one obtain venture capital

Though the procedure usually follows a set sequence of simple steps, there is no sure path to get venture capital.

- Look into making an investment.

- Look for venture capital firms or for private investors, also known as "angel investors." You may ascertain whether the investor is trustworthy and has past experience working with start-up companies by doing a thorough background research.

- Share the proposal from your firm.

- The investor will review your business plan to ensure that it meets their needs for finance. The majority of investment capital is concentrated in a certain industry, region, or stage of business growth.

- Conduct a due diligence investigation.

- Investors will go at the financial statements, corporate governance records, market, products and services, and management team of your business.

- Here, work out the terms.

- Should they decide to invest, the next step is to agree on a term sheet that details the terms and conditions for the fund to make an investment.

Help your business using crowdsourcing

Through crowdsourcing, or crowdfunders, a business may raise capital from a number of different people. Since they do not receive equity in the company or a profit on their investment, crowdfunders are not considered investors in the traditional sense.

Rather, in exchange for their support, crowdfunders want a "gift" from your business. Usually, the gift is something you wish to sell or another unique offer, such paying a visit to the business owner or mentioning their name in credit terms. For those looking to create tangible products like high-tech coolers or creative works like documentaries, crowdsourcing is a common choice.

Additionally, crowdfunding is growing in popularity as it poses very little risk to business owners. In addition to having complete control over your business, you frequently do not have to reimburse crowdfunders in the event that your concept is not successful. Since each crowdsourcing website is unique, make sure you read the fine print and comprehend all of your financial and legal responsibilities.

Read also: Explaining Carried Interest: Who It Helps and How It Operates

Applied for a small business loan

Consider applying for a small business loan if you want to be the company's ultimate manager but don't have the initial capital.

Should you possess a solid strategy, budget, and five-year financial projections, your chances of getting a loan will rise. With the use of these tools, you can determine how much you'll need to ask for and convince the bank that granting you a loan is a wise move.

Prepare, then call banks and credit unions to see if you can get a loan. In order to obtain the greatest conditions for your loan, you need consider your options.

Use Lender Match to find lenders who offer loans guaranteed by the SBA.

If applying for a traditional business loan proves to be challenging, consider SBA-guaranteed loans. If a bank feels your business is too risky to lend money to, it may agree to have the U.S. Small Business Administration (SBA) guarantee your loan. As a result, the bank is less likely to take on risk and is more willing to lend money to your business.