A governance framework, also known as a governance structure, is required for effective governance and legal activities. Governance frameworks govern how individuals engage with the company, regulators, and stakeholders, guiding and monitoring activities carefully.

A governance framework is a supporting structure for entity management and compliance that serves as the foundation for the many branches of compliant operations to flourish. Along with entity management technology, governance assists businesses and other organizations in meeting regulatory filing requirements as well as issues such as corporate culture, pay techniques, and operational transparency.

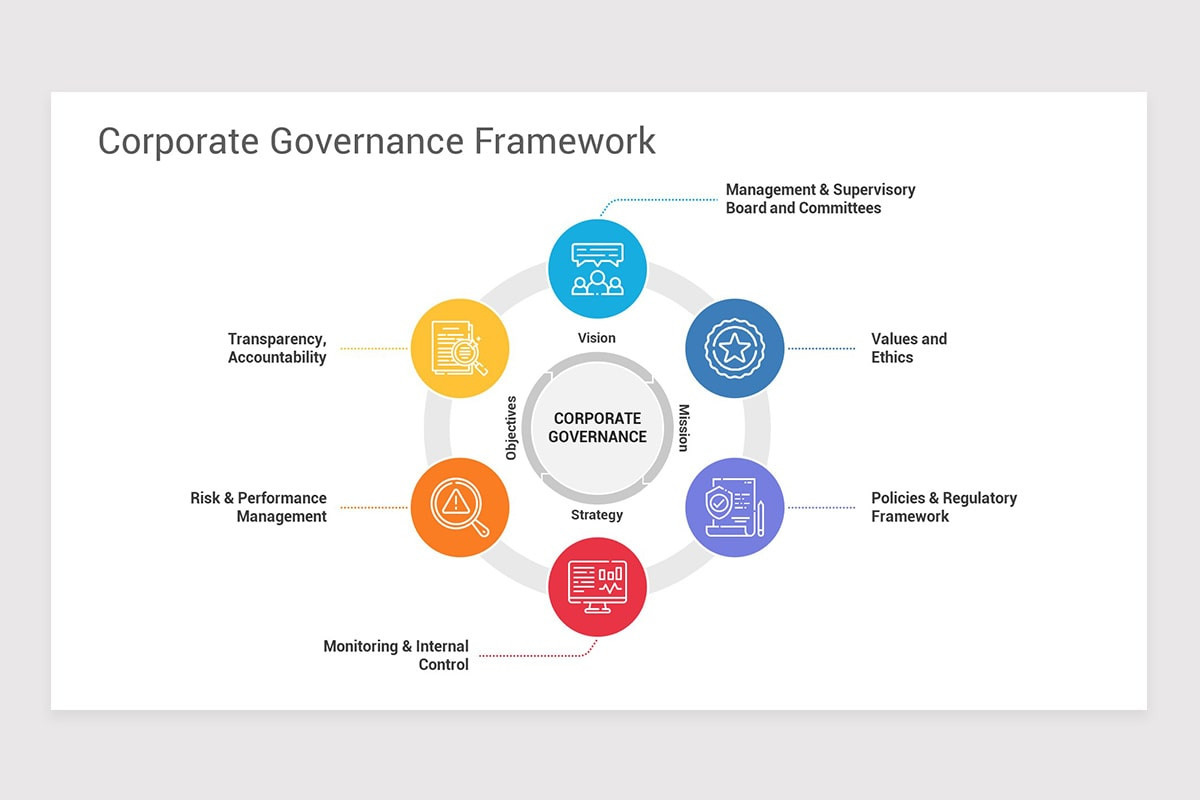

A corporate governance framework helps to focus an organization's approach on common themes such as who has a say, who makes choices, and who is accountable. The governance framework serves as a crucial supporting structure, a set of rules and procedures by which the board assures accountability, fairness, and openness in how the firm operates and interacts with stakeholders.

Here, we'll describe the essential principles that support corporate governance systems, including:

- Governance framework vs governance structure.

- Components of a Strong Corporate Governance Framework.

- Five Advantages of an Effective Corporate Governance Framework.

- Why Governance Frameworks Are Important.

- How to Build Your Framework.

- Software that may improve your governance approach.

Read also:

- What Is Enterprise Software Development

- The ArcOps: Connected enterprise architecture-operations pipeline

- What is a business enterprise?

- The Enterprise Product Manager: What Is It? Value & Role

Governance framework vs governance structure.

The phrases 'governance framework' and 'governance structure' are synonymous. They both define a system of governance for an organization, including the rules, processes, and roles of responsibility that impact it.

These frameworks or institutions often regulate persons in positions of power, such as CEOs and boards of directors. They choose how they will carry out the actions that propel the company ahead.

Examples of governance structures?

Good corporate governance arrangements may help firms become more competitive. With effective governance, firms ensure that all of their actions are consistent and meet regulatory requirements, ensuring the board that their rules and processes benefit the company.

What are some examples of good governance structures?

Integrating board activities: Boards and their organizations may quickly become siloed. These silos are not only wasteful; they also expose the board to expensive oversights. Good governance frameworks will integrate all board operations, usually using entity management software.

Strategic internal auditing: Boards need data to make informed choices. This makes the internal audit role vital. A solid governance system would emphasize frequent and continuing internal audits to identify risks and keep the board informed.

Industry and regulatory standards: Compliance is important to all board and organizational actions. It guarantees that all processes and procedures comply with important requirements, such as ISO certification. Meeting these sorts of requirements is important to any strong governance framework.

What characterizes a robust corporate governance framework?

A solid corporate governance structure integrates operational, risk management, reporting, and financial activities to keep the board informed. Rules and processes combine to provide a strong governance framework, which serves as the foundation for the strategic plan. A robust governance framework can:

- Assist boards in making informed, data-driven choices.

- Identify holes or flaws within the board or management.

- Support the organization in different ways to successfully link leadership and operations.

- Serve as a crucial instrument for successful board oversight; the process of establishing the framework is frequently just as significant and meaningful as the outcome.

- Bring power and responsibility while allowing for effective decision-making in a company.

What are the five advantages of a good corporate governance framework?

A strong governance system may have a wide-ranging influence. Though governance is most usually discussed in boardrooms, it has far-reaching consequences both internally and internationally. Organizations that effectively implement governance frameworks might expect:

Effective risk management: A strong governance framework comprises mechanisms for discovering, analyzing, and managing risks, resulting in improved risk management practices. Robust compliance processes, ethical norms, and risk management strategies may help organizations avoid regulatory infractions and lawsuits and instead focus on performance.

Enhanced openness and accountability: A corporate governance structure encourages transparency by providing stakeholders with clear information about the company's activities, finances, and decision-making. Transparency fosters trust, which inspires devotion to the company.

Improved decision making: Organizations with a strong governance structure provide the roles, responsibilities, and procedures that lead informed decision-making. Timely board decisions result in improved resource allocation and long-term sustainability.

Protection of stakeholder interests: Corporate governance systems, notably the stakeholder model, place a high value on stakeholders. An successful framework enables organizations to prioritize stakeholder interests, assure ethical treatment, and establish confidence.

Better financial performance: For investors and customers, corporate governance is a sign of a well-managed, ethical organization. This reputation advantage makes it simpler for enterprises to acquire capital and loyal consumers, therefore improving their long-term profitability.

What is the value of governance frameworks and structures?

Corporate governance arrangements are critical in today's dynamic and competitive corporate climate. Corporate governance enables businesses to highlight their strengths. With these goals obvious to everybody, businesses are more likely to be held responsible for their behaviour and actions, and hence more eager to remove themselves from deception.

Investors and consumers alike hold businesses today to very high standards; honesty and transparency about procedures and operations are essential. Both shareholders and customers want to see firms operate with honesty and openness.

What are the primary components of a governance structure?

PwC, a business advice firm, refers to corporate governance as "a performance issue" since it offers a framework for how a company functions. Corporate governance frameworks should include the following:

- The board's performance as well as the company's.

- The Board's Relationship with Executive Management.

- The selection and evaluation of the board's directors.

- Board membership and tasks.

- The company's "ethical tone" and how it operates.

- Risk management, business compliance, and internal controls.

- Communication among the board and the C-suite.

- Communicating with shareholders.

- Financial Reporting.

This list gives a bird's-eye perspective of corporate governance in action and explains how it affects business. Deloitte provides a governance framework to assist firms in navigating corporate governance. It describes the board's goals and duties, as well as how they connect to the corporate governance infrastructure.

Read also:

- Enterprise Architecture: What Is It? Definition and Structures

- Enterprise Technology: What Is It? Determining and Using

- The 10 Most Successful Business Enterprises in the USA

How can you start creating your own corporate governance framework?

Governance frameworks exist to guarantee that a corporation stays compliant and operates within legal bounds. This means that any governance structure must take into account local rules wherever the organization has entities. The governance framework then establishes the governance operational model that is suitable for the organization's goals.

To begin creating your own governance structure, attempt to answer these questions:

- Who has power in your organization?

- What information must those individuals get, and when?

- What is the organizational structure like?

- How does structure impact decision-making?

- What are the organization's reporting requirements?

- How does information need to move throughout the business?

- What is the connection between entities, and does it pose any issues in terms of accountability, authority, or responsibility?

- What is the connection between departments and their stakeholders?

- Where are the organization's entities headquartered, and how does it affect obligations?

What is the governance structure for portfolio companies?

A strong governance structure steers an organization toward responsibility, authority, and good decision-making. In contrast, a poor corporate governance structure would disrupt the investment process and have an impact on overall economic development. A governance framework for portfolio firms should guarantee that all shareholders have the opportunity to vote on governance issues. Every shareholder should have a voice and fundamental rights.

Portfolio firms should conduct business in the best interests of its shareholders as well as the cash entrusted to them. A portfolio company's governance structure should consider the following and demonstrate:

- The company's capacity to develop value—and deliver long-term profits—in response to demand.

- Accurate and timely disclosure may help investors forecast their profitability.

- Commitment to ethical behavior as a member of society.

- A dedication to satisfying corporate social duties, including, but not limited to, the organization's environmental effect.

A portfolio company's governance structure should guarantee that the foregoing promises are met while the business fulfills its market participant duties.

What is the governance structure for subsidiaries?

It's normal for organizations to seek out new entities to drive corporate expansion and cope with more complicated laws, but each new entity brings with it a greater requirement for entity management and rigorous subsidiary control.

Globalization presents legal and corporate governance challenges at the subsidiary level, which need ongoing attention. To cope with this, many company secretaries and legal operations experts use a subsidiary governance structure template to assist keep things in order.

Corporate governance framework templates give recommendations and suggestions for ensuring that downstream and upstream corporate governance flows are strong and compliant.

A subsidiary governance framework template may assist to harmonize procedures while leaving opportunity for local activity. It offers a framework that allows individuals in charge of subsidiary governance and entity management to choose what works best for them and their requirements while ensuring that policies and practices typically comply to what the parent company wants.

Enhance your company governance structure using entity management software.

Entity management software helps the governance framework by consolidating stakeholder and entity data into a centralized repository that can be accessed from anywhere in the globe. This is crucial since more board members, executives, and workers work remotely, thus they must be able to adhere to the governance framework regardless of where they log on. Boards need not simply means to digitize their governance processes, but also tools that can use their governance framework to gain a competitive edge.